Long-Term Disability Lawyers in Nova Scotia

Long-term disability (LTD) is a topic of great concern to many people in Nova Scotia. The purpose of LTD benefits (Long Term Disability benefits) is to provide some measure of income replacement when an individual is unable to work as a result of injury or illness. However, in some cases, insurance companies may deny your claim and deprive you of receiving these benefits. If you find yourself in this stressful situation, you should contact one of our long-term disability lawyers in Nova Scotia to explore your legal options.

Individuals who have been injured or have an illness and seek support from their LTD insurer expect to be supported. If you filed a long-term disability claim, you may depend on these payments to meet your ongoing financial obligations. Therefore, having your claim denied or delayed can cause great stress and anxiety.

We are long-term disability claims lawyers at Kimball Law. It is our job to help Nova Scotians whose claims have been denied to obtain their LTD benefits. We understand the difficult situation that you and your family may be going through. Our goal is to ease the financial stress and emotional upset that you are experiencing as a consequence of not receiving benefits you need.

If your claim has been denied, our Halifax disability lawyers can help you navigate this complex process. Call 1 (902) 422-8811 today to schedule a free consultation. If you are wondering how these benefits work, in the sections below, you will find essential information about long-term disability claims in Nova Scotia.

What are Long Term Disability Benefits?

In Nova Scotia, Long Term Disability benefits provide income support to individuals who are unable to earn their regular income from employment due to an illness or injury. LTD benefits are provided by private insurance companies and are meant to support people who cannot work on a long-term or permanent basis.

Long-Term Disability Insurance is a type of insurance sold by insurance companies either directly to someone as a private policy, or more often as part of an employer sponsored group policy. LTD benefits in Nova Scotia are designed to address the consequences of illness or injury that prevent an individual from returning to the work force permanently or for a considerable amount of time.

Given that the terms of insurance policies may differ from each other, there will be a variety of differences in the coverage available depending on the insurance company. However, as a result of the provisions of the Insurance Act and other common practices in the industry, most policies provide for an initial disability period, which is usually 30 days.

Once the initial disability period is over, you will go through a process which is often referred to as an elimination period. In simple terms, this stage is a delay in the provision of benefits. Its purpose is to determine if other benefits, such as Employment Insurance Sickness Benefits or employer sponsored Short Term Disability Benefits, may be available to provide income assistance/support for the worker.

As its name suggests, long-term disability is not intended to cover short-term interruption of work due to illness or injury. Therefore, LTD benefits in Nova Scotia will begin once the elimination period is complete. This ensures that people who are temporarily disabled from employment are not filing for long-term benefits.

The elimination period for most policies in Nova Scotia is typically up to 4 months. If after this period you continue to be off work as a result of illness or injury, payment of your long-term disability would commence.

In Nova Scotia, many claims for disability benefit coverage are paid without any need for legal intervention once the necessary medical documentation has been provided. However, if your claim has been denied, you should contact a Halifax disability lawyer to explore your options.

Disability Benefits Available for Nova Scotians

In addition to long-term disability, Nova Scotia residents have the opportunity to apply to different disability programs. Nevertheless, it is important to consider that income support benefits are only available to individuals who are working when their ability to work and earn income is interrupted as a result of illness or injury.

The following are some of the different support systems that are generally available to people:

- Employment Insurance (EI) provides coverage for individuals who experience a shortage of work for a period of time. One of the benefits available through the EI program is the provision of up to 15 weeks of sickness benefits. These benefits are available to people who have paid into the employment insurance program through employment and are unable to work because of illness or injury.

- Canada Pension Plan also provides disability benefits for individuals who have paid into that program through employment premiums and are unable to continue earning employment income because of a severe and prolonged disability.

- Workers Compensation is applicable to a worker who is employed by a business registered with the Workers Compensation Board in the province. This kind of benefit is to cover loss of income attributable to a workplace injury.

How Much Do You Get for Disability in Nova Scotia?

In Nova Scotia, disability benefits will vary depending on the particular coverage provided under the insurance policy. LTD benefits provide partial income replacement. Typically, they cover between 60% and 70% of the person’s usual gross monthly income/salary without regard to overtime income.

For instance, David’s monthly income is $3,500. However, after being injured in a car accident, he is not able to return to work and he has to file for long-term disability in Nova Scotia. After assessing his case, his insurance company approves his claim. Based on the terms established on policy, his LDT benefits will provide coverage for 60% of his income. Therefore, he will receive $2,100 monthly payments.

Since they are meant to provide partial income replacement, long-term disability benefits will almost never be a full replacement of a person’s working income and in no case are these policies designed to provide more income from disability benefits than the person would have received from their regular salary.

What Does Qualify for Long Term Disability in Nova Scotia?

Long Term Disability in Nova Scotia arises when a person is unable to earn income from employment as a result of a serious illness or injury. In this type of claim, being employed at the time the disability arose is key. In other words, even if you suffer an illness or injury that is disabling in nature, you will not be eligible to file for benefits unless you were employed at the time of the event giving rise to your disability.

Illnesses

In the context of long-term disability claims, there are many medical situations that qualify as disabling. For example, someone may suffer from cancer, heart disease or other serious medical condition that renders them unable to continue working.

Injuries

In many situations, a person otherwise healthy may suffer a serious and disabling injury. If this condition is serious enough that it appears the person will not be able to return to work, and they otherwise qualify as insured persons under the policy (i.e., they were working at the time of the accident) then they would be entitled to make a claim.

Individual vs Group Policies

Individual polices name an individual as the insured. Group policies through employment do not name the individual per se but because the individual is a member of that employment group and premiums are being paid through their employment deductions they automatically qualify as insured individuals under the policy and would be entitled to make a claim for benefits.

When people in Nova Scotia have been denied benefits they think they are entitled to receive, they should seek legal advice. If you find yourself in this difficult position, a Halifax long-term disability claims lawyer can review your situation and help you determine if you are eligible for making a claim.

How Long Does Long Term Disability Last?

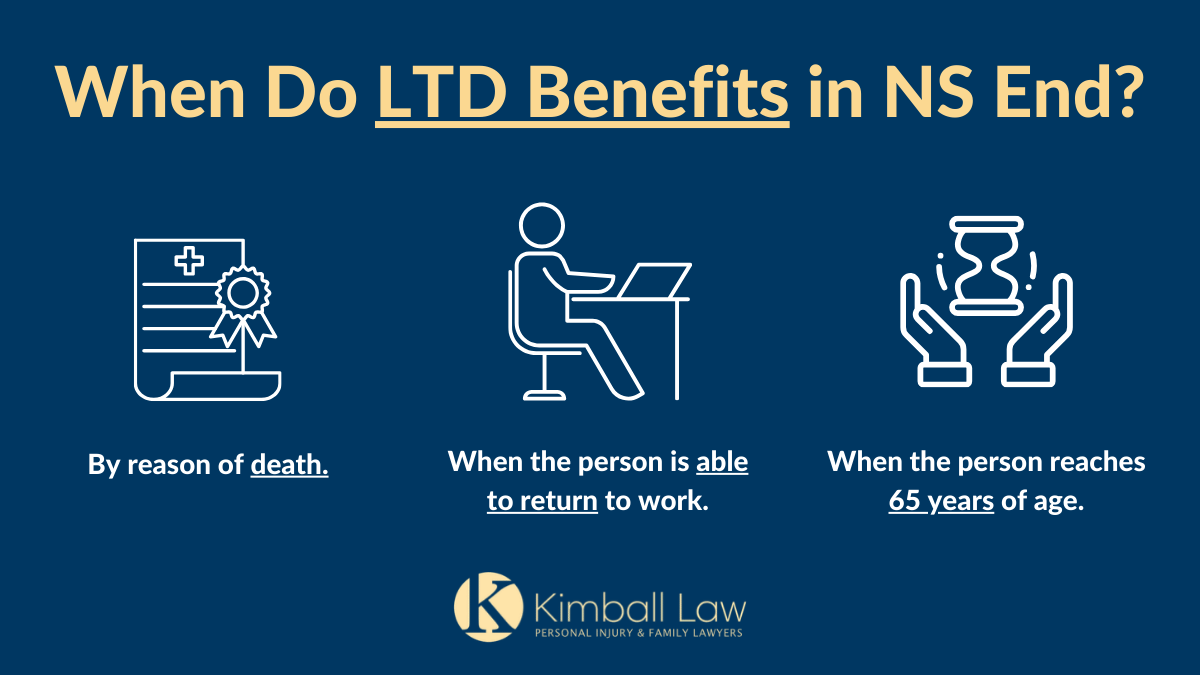

In Nova Scotia, long-term disability benefits terminate:

- By reason of death

- When the individual is able to return to work

- When the person reaches 65 years of age

LTD benefits cover up to 2 years if claimants cannot perform their own occupation. Benefits may continue beyond two years if the person cannot engage in any occupation.

When you are in receipt of benefits, the insurance company has the right to require periodic medical assessments to determine whether you continue to meet the definition of disability. If as a result of such an assessment, the insurance company determines that the individual no longer meets the definition, they will terminate the payments. If you feel that you have been unfairly denied continuing benefits, you should seek legal advice from a long-term disability lawyer.

Change of Definition: Own Occupation vs. Any Occupation

Change of Definition: Own Occupation vs. Any Occupation

By definition, long-term disability is long term and contemplates that the individual will be disabled for a significant period of time, usually permanently, for the rest of their working life. But when it comes to providing benefits, insurance policies typically distinguish between two situations where a person is disabled from doing their ‘own occupation’ or disabled for engaging in ‘any occupation’.

In most policies, long-term disability coverage provides benefits for the first two years if you are unable to carry out the usual duties of your own occupation. However, at the point designated in the policy (usually at the two-year anniversary of payments) the definition of “occupation” will change from ‘own occupation’ to ‘any occupation’.

At that point, your case will be assessed to determine if you are eligible for continued coverage. To do so, the insurance company evaluates whether the individual is able to carry out the essential duties of any occupation (not limited to their own or former occupation) for which they are reasonably suited by virtue of education, training or experience.

In simple terms, this means that many individuals who find themselves disabled from performing their own occupation will be able to transition to a different kind of work using different skillsets or training. As a result, they will be able to re-enter the work force.

The change of occupation definition often results in individuals being deemed no longer eligible to continue receiving benefits after two years. If this happened to you or a loved one, you may wish to obtain legal advice to determine whether indeed you continue to be eligible to receive ongoing long-term disability benefits in Nova Scotia.

CPP Disability & LTD Benefits

It is usually a condition of long-term disability insurance policies that individuals receiving benefits also apply for Canada Pension Disability Benefits. Any amount received from CPPD will be deductible from the LTD disability benefits.

For example, let’s say that Joanne’s long-term disability benefits are calculated to be $2,000.00 a month. However, her CPPD application is approved, and she will receive Canada Pension disability in the amount of $1,000.00 per month. At this point, the LTD insurer would only be required to pay the difference ($1,000.00 per month) by way of ongoing benefits.

Applying for Canada Pension disability benefits is usually an important step in pursuing long-term disability benefit. The average monthly CPP disability benefit is approximately $1,065.00 in 2022. But depending on how much you paid into the plan when you were working, at present you could receive anywhere from $525.00 to $1457.00 per month.

Whatever that amount is determined to be, is an offset (deduction) from the LTD benefits your insurance company would otherwise pay.

Filing Your Claim Yourself vs. Hiring a Disability Lawyer:

When you find yourself unable to work by reason of illness or injury and you have received medical advice that this will be an on-going disability, it is normal for an individual to open a claim with the insurance company. Generally speaking, legal advice and support is not required at that stage. However, if a claim is denied, then it may be necessary to discuss your claim with a Long-Term Disability lawyer to review your legal options.

Dealing with insurance companies when you are worried about your family and health can be overwhelming. If you suffer from an illness or work-related injury, you might be entitled to receive long-term benefits. Kimball Law is a Nova Scotia personal injury law firm that represents clients in the HRM including Halifax, Dartmouth, Bedford. In addition to the Annapolis Valley, including, but not limited to Wolfville, New Minas, Kentville, and Coldbrook.

If you have questions about your long-term disability claim, you should seek legal advice. Contact us via email form or call us at 1 (902) 422-8811 to schedule a free consultation with the disability lawyers from Kimball Law.

F.A.Q.’s:

Are long term disability benefits taxable?

Typically, long-term disability benefits may taxable depending on who paid the premiums. If the employer paid some or all of the premiums, the beneficiary will be requested to pay taxes. However, if the employee paid their own premiums, LTD benefits are considered non-taxable.

Can you go on vacation while on Long Term Disability?

You can go on a vacation while on long-term disability. The question to be determined in every case is whether your medical condition (illness or injury) renders you unable to engage in the essential duties of your own occupation or the essential duties of any occupation (depending on the applicable definition). So, it is quite conceivable that a person meets the definition and can still go on vacation. The question is whether the vacation activities are inconsistent with the other evidence or information supporting their disability.

An analysis of whether the vacation activities are consistent or inconsistent with a disability claim is a question of fact and the particular circumstances. It is not unusual for an insurance company to gather evidence to demonstrate that the person’s activities are inconsistent with the claim being advanced for long-term disability.

When can you claim long term disability?

You can claim long term disability if you are unable to continue with your regular employment by reason of illness or injury and it appears that this will not be a short-term interruption of your employment. You should seek advice from your doctor about whether your condition may permanently affect your ability to work. If so, you should file your claim for benefits at that time.

Change of Definition: Own Occupation vs. Any Occupation

Change of Definition: Own Occupation vs. Any Occupation